Check out our recent video on Cash Management in Your Construction Business: The Cash Cycle

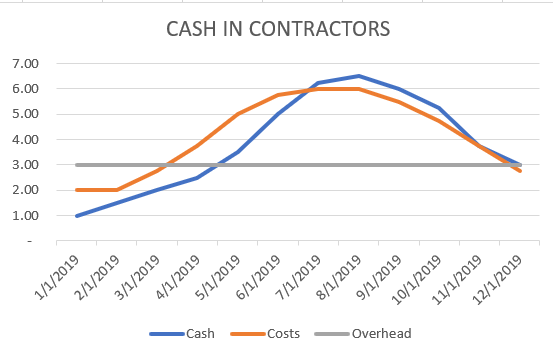

We’ve had enough experience in the construction industry to know that one thing’s for sure: It’s not hard to find yourself in a cash crisis. Because no matter what time of the year or how busy you are, your firm could be dealing with a cash crunch from a ramp up in work or the closeout of projects where you’re trying to collect retention and all of your profit. You can find yourself funding all of your projects, no matter how profitable they are, and struggling to get ahead. That’s why cash management is always a topic worthy of discussion.

The Typical Cash Cycle in Construction

Some contractors have a system in place that enables them to avoid having to fund the job. But for most of the contractors we work with, the general cash cycle is:

- Cost Build Up

- Payroll

- Material

- Subcontractors

- Invoice the Customer

- Wait for Payment

If you’re a general contractor, you usually have a shorter waiting period for payment. If you’re a subcontractor, however, you could be waiting up to 60-70 days to receive payment. During this time, costs keep accumulating — costs that you need to find the money to fund. It’s pretty easy to see why this cycle can present some cash flow challenges. And even after you bill, you continue to accumulate costs (from subcontractors, materials and labor still hitting the job).

Let’s be honest, most contractors didn’t get into business to be a bank. But many times, that’s what the billing schedule calls for. And that’s exactly why you need to make sure you have a good relationship with your banker, in order to fund your jobs.

So what exactly is the problem with the typical cash cycle described above? It boils down to the lag time between the cost build-up, billing the customer, and finally receiving payment, plus closing out the job and receiving retention (which is when we typically exceed our costs and see a profit). Contractors experience this over and over throughout the year. Many of the contractors we work with do a lot of their work in the summertime and collect their cash by fall, but it really depends on where your company is with regard to progress on the current workload. Cash management can be an issue any time of the year.

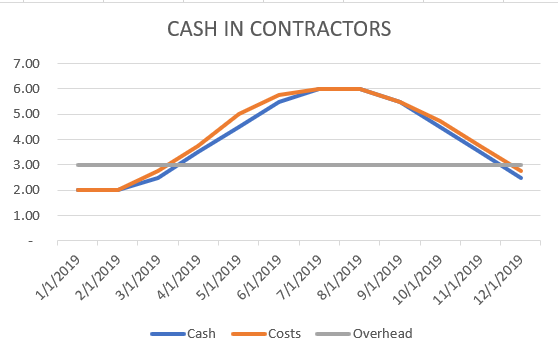

The Ideal Cash Cycle in Construction

You’re probably wondering, what should the goal be when it comes to the cash cycle? Ultimately, we need to shorten the window between our costs being paid out and our cash being collected. You don’t want major swings and lapses between cost build-up, billing, and collection. Our goal should be to make sure that we don’t have to fund the project. There should be a system in place that enables us to cash flow the project and make it easy on all parties involved, from owners to vendors and subs to employees. Start with reviewing the cash cycle for your business as a whole to see if you are struggling to keep cash on hand, constantly under billed on projects or relying on your line of credit to pay bills. If you are then focus on your larger projects to see if they are cash flowing or if they need attention.

If you need help better understanding the cash cycle or managing cash flow, we hope you’ll take advantage of some of these additional resources we offer: