Getting a “no” answer from a bonding agent or surety is frustrating.

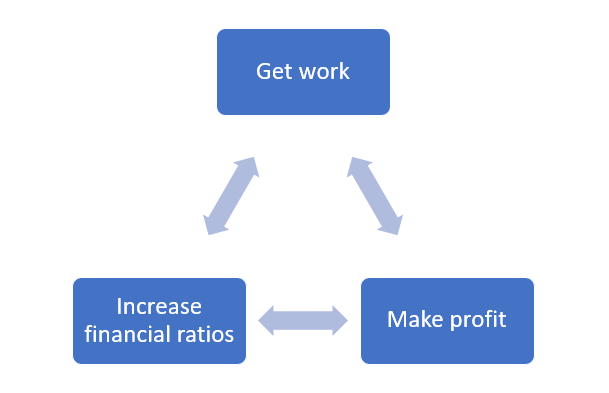

And it seems counter-intuitive, because you need the work to make the profit that the surety wants you to have, but…they won’t give you the green light on the work you need to make the profit. Right?!

Because it feels counter-intuitive, it helps to dig into the reasons behind the “no” and what you can do about it today. That way you can get the bonding program you want for your future growth.

From our vantage point, sitting in the CFO role, bonding limitations fall within two categories:

- Financial strength of the company

- Working capital

- Equity

- Debt load

- Relationship with the surety

- Consistent financial data

- Communication and discussion

We’ve done several posts on the financial side of the surety relationship. Today we are focusing on the relationship and introducing a tool that we have used to build trust—The Narrative (A.K.A. story time).

There are two ways to share knowledge.

You can push information out.

You can pull them in with a story.

– Anon.

Everyone loves a good story. From our experience in the construction industry, there are a ton of good stories and lessons learned. It is the stories and the lessons that help create the business. Each story or lesson was a catalyst for something new or different in the business.

Stories are also a part of building relationships. You can use a narrative to showcase the financial strength of the company and build a relationship at the same time. We find clients that provide narratives have a stronger relationship, get the help they need, and get fewer questions than those who send financial data without the story behind the results.

The goal of the narrative is to share the wins and the struggles in the business, the plans for growth or overcoming obstacles, and to tell the story that lead to the financial data that the surety is asking for.

When building the story there are a few key points to remember:

- Good stuff

- Bad stuff, “but now”

- Financial stuff

This format shows your surety or banker that you have control over and knowledge of the business and that you are paying attention to good stuff, bad stuff, and financial stuff.

Another thing that helps with sureties and bonding is a properly set-up WIP job schedule. We’ve got a full course on creating a WIP so you can grow your bonding and surety program. If you want to learn more, click here.